FCA disclosure requirements

1. Introduction

1.1 Purpose and Scope

This document presents the FCA Disclosure Requirements (previously referred to as the Pillar 3 disclosures) for Titan Private Wealth Ltd (‘TPML’ or ‘the Firm’) which is authorised and regulated by the Financial Conduct Authority (‘FCA’). From 1st January 2022, TPML has been regulated under the FCA’s new Investment Firm Prudential Regime (‘IFPR’) as an Non SNI MiFID investment firm.

This document contains the disclosures required by the FCA rules at MIFIDPRU 8. It requires Non SNI investment firms to publicly disclose certain details regarding capital resources, risk exposures and governance and risk management arrangements.

These FCA requirements are intended to ensure that TPOML’s disclosures are sufficient to allow participants to form an assessment of the Firm’s risk profile and capital resources on a basis comparable with other regulated financial services firms.

1.2 FCA Disclosure Policy

All disclosures, unless otherwise stated, apply as at 31 March 2023 or for the 18 months ending 31 March 2023 in line with the Firm’s financial year end. All disclosures are for TPML on a standalone or company basis.

The disclosures are prepared on an annual basis solely for the purposes of complying with FCA requirements. The disclosures have not been audited and do not form part of the annual audited financial statements of the Firm. However, they are subject to internal review and verification and are approved by TPML’s Board of Directors. The Firm may consider it appropriate to publish updated disclosures more frequently should a significant change in business or operating environment require this.

TPML’s disclosures are considered to be appropriate to its size and internal organisation, and to the nature, scope and complexity of its activities.

2. Governance Structure

The Board of Directors is the ultimate decision-making body for the Firm. The Board defines the purpose and values of the Firm, develops the Firm’s business strategy, and is responsible for directing the Firm’s business and the management of risks that arise in the course of doing business. The directors meet regularly and are collectively responsible for ensuring that the Firm’s operations are aligned to the strategy, regulatory compliance requirements and good governance practices, including how the Firm will act fairly with all stakeholders. The Board met formally circa four times during the financial year. Meetings are minuted and the Board has a schedule of regular and standing agenda items.

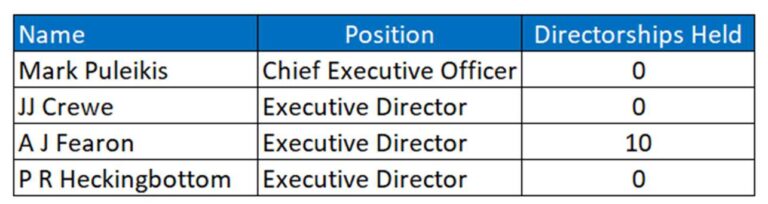

As at 31 March 2023, the number of external directorships held by members of the

Board outside of the Titan Wealth Group were as follows:

For details of the directors who held office during the year and up to 31st March 2023 please see the Directors Report included in CAML’s Annual Report and Financial Statements.

2.1 Board Level Committees

The Directors of CAML manage the business through a clearly defined and robust governance and decision-making framework that is consistent with CAML’s application of the three lines of defence risk management model as set out below:

CAML’s Board is responsible for overseeing the effectiveness of risk management, compliance and CAML’s internal control framework. It also sets CAML risk appetites and approves key policies.

The Board is also responsible for:

• Monitoring CAML’s key current and emerging risks and opportunities.

• Reviewing and monitoring CAML’s risk profile based on information generated from the Risk Management Framework.

• Reviewing significant findings of the external audit, reports of fraud or other financial irregularities, together with management’s responses.

• Monitoring CAML’s relationship with the FCA and other key regulators. This includes reviewing CAML’s responses to regulatory reports, compliance breaches and regulatory changes.

• CAML’s risk culture is effectively embedded across all activities.

• Reviewing risk events including near misses.

CAML’s Remuneration Committee considers staff and remuneration policies. Annual remuneration is determined on a discretionary basis accounting for a variety of factors including performance and risk behaviours. There is no set formula directly linked to performance. The Remuneration Committee refers its recommendations to the Board for approval.

2.2 Executive Committees

The Executive Committee is responsible for the day-to-day activities of the firm and ensuring that business operations are within the parameters of the risk management framework. It meets weekly and is comprised of six members.

As appropriate, the Executive Committee will establish Management Committees and Working Groups to advise on specific projects, issues or risks. These currently include a Management Committee, Stock Selection Committee and an Asset Allocation Committee. They meet regularly and key findings are escalated to the Management Committee and, where appropriate, the Board or the relevant Board committees.

3. Risk Management

In order to ensure appropriate management and monitoring of the firm’s risk profile, CAML has established the governance framework outlined above. The Board has approved a Risk Management Framework which sets how out the Firm’s approach to risk appetite, governance and management processes.

3.1 Risk Management Framework

CAML’s Risk Management Framework (“RMF”) defines the firm’s approach to risk appetite, governance and management processes. The Risk Management Framework (RMF) is designed to provide senior management with assurance that risks are being appropriately managed and that the system of internal risk control is adequate, with assurance provided through transparent, timely and objective risk reporting and disclosure.

The RMF includes the following components:

– Risk Appetite Statements for each key risk

– Setting out the risk culture of CAML

– Defined scheme of risk classification (Risk Taxonomy)

– Maintaining three lines of defence for risk ownership, oversight and assurance

– Risk identification, assessment and measurement and management processes

– Risk monitoring and reporting process based on key risk indicators

– Scenario analysis and stress testing

3.2 Principal Risks

Strategic Risk

Strategic risk is the risk from failures in business planning and execution, or changes in operating environment or the structure of target markets that make any current strategies inappropriate. This risk is managed through financial management information, monitoring of economic data and market trends as well as keeping close to our clients, bankers, dealers and potential investment opportunities.

Credit Risk & Settlement Risk

Credit Risk is the risk of default if a client or a counterparty is unable to meet its obligations as they fall due. This includes the credit and settlement risk related to transactions that the firm may enter into in its own name and any exposures inherent in its balance sheet. It excludes the risks associated with transactions a firm may arrange for its portfolios or clients that the firm may manage.

Operational Risk

Operational risk is the risk of loss resulting from inadequate or failed internal processes, people and systems or from external events. This covers both the operational risks inherent in the firm’s operational arrangements as well as the operational risks inherent in business processes. Operational risk includes IT risk, fiduciary risk and the risk of non-compliance with legal and regulatory requirements. An Operational Risk Management Policy and Framework has been endorsed by the Board and sets out how the firm manages operational risks.

The Firm undertakes a detailed risk assessment process annually across all departments to identify potential sources of operational risk, on an inherent basis, including identification of controls with an assessment of the residual risk per event. Residual risks that are determined to have a high impact and likelihood are reviewed with a view to implementing additional controls or strengthening current controls. To manage, monitor, and mitigate operational risks, CAML has established:

– Annual Risk Assessment using risk matrices

– Security standards for technology infrastructure

– Business Continuity Planning

– Daily reconciliations

– Regular management information and escalation paths for incidents/events

– In-depth analysis of new services, products or business initiatives

Liquidity Risk

Liquidity Risk is defined as the risk that a firm, although solvent, either does not have available sufficient financial resources to enable it to meet its obligations as they fall due or can only secure such resources at excessive cost. CAML is subject to liquidity risk when it cannot pay monies due to a client, counterparty or creditor, where CAML does not have sufficient money to pay for a share or bond purchase or where liquidity is only available at an excessive cost.

Market Risk

Market Risk is the risk of loss due to adverse changes in the price of financial assets. CAML does not buy or sell securities in its own name. Any incidental FX exposures are measured in accordance with FCA rules.

Concentration Risk

Concentration risk is the risk arising from exposures to groups of connected parties, counterparties in the same sector, or counterparties undertaking the same activity. Concentration risks are incorporated into the specific risk assessments for credit, market and operational risk as indicated above.

Interest rate risk

Interest rate market risk is defined as the risk that the fair value or future cash flows of financial instruments will fluctuate because of changes to the yield curve and volatilities in market interest rates. The firm does not hold financial instruments and therefore its main exposures to interest rate risk is to fair value interest rate risk on its fixed rate borrowings and cash flow interest rate risk on floating rate deposits, bank overdrafts and loans.

Regulatory Risk

This is defined as the risk of the effect of changes in laws or regulations that could potentially cause losses to CAML. As an FCA regulated firm, CAML is required to follow all relevant FCA rules and requirements in addition to relevant EU Regulations and MiFiD and MiFiR specific requirements. Under CAML’s business model the Firm holds customer assets under the FCA’s CASS requirements.

The Firm mitigates and controls its regulatory risk through:

– A Compliance monitoring plan designed to cover all regulatory risks

– Relevant policies and procedures covering the Firm’s obligations

– Regular management information and updates to the Board or relevant committee(s)

– Regular mandatory staff training on Firm and personal obligations and responsibilities

4. Internal Capital Management

The Firm’s capital management strategy is to maintain sufficient capital resources for its size and complexity of business both in the present and in order to facilitate future growth.

CAML monitors its financial adequacy regularly and undertakes a formal internal capital and risk assessment at least annually to identify and manage its principal risks and capital requirements in both business-as-usual and stressed scenarios.

This assessment has been conducted in accordance with the FCA’s Internal Capital Adequacy And Review Assessment (ICARA) requirements and expectations.

In accordance with the overall financial adequacy rule, CAML manages and monitors its principal risks and considers the impact of stressed scenarios on its requirements to determine the amount of own funds and liquid assets, in terms of both amount and quality, it requires to remain financially viable throughout the economic cycle and to address any material potential harm that may result from its ongoing activities. It also considers the amount of own funds and liquid assets it would require if, for whatever reason, CAML decided to wind down to ensure that this would be done in an orderly manner, minimising harm to consumers or to other market participants.

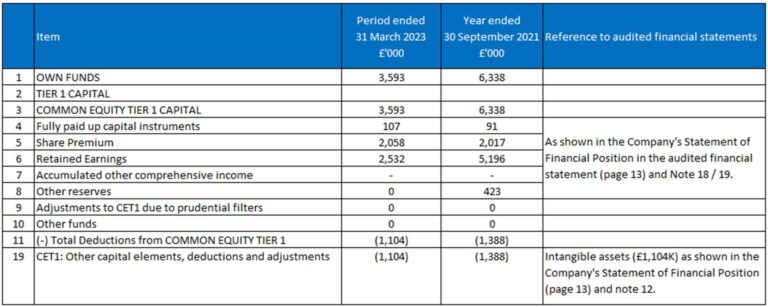

4.1. Own Funds as at 31st March 2023

CAML’s Own Funds as at 31st March shown were calculated in accordance with IFPR and reconciled to CAML’s audited Company Statement of Financial Position as indicated below.

CAMLs share capital consists of allotted, called up and fully paid ordinary shares.

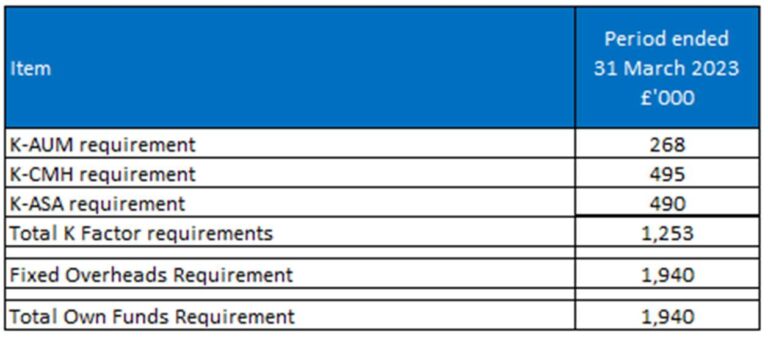

4.2 Own Funds Requirement as at 31st March 2023

As at 31st March 2023, CAML had the following minimum capital requirements:

5. Remuneration

In accordance with the CRR remuneration disclosure requirements (Article 450), as further elaborated in the FCA’s “General Guidance on Proportionality: The Remuneration Code (SYSC 19A)”, as an IFPRU limited activity firm CAML falls within proportionality level 3. The Firm is required to provide the following disclosures regarding its remuneration policy and practices for those categories of staff whose professional activities have a material impact on its risk profile.

5.1 Policy and Governance

CAML has established a remuneration policy in accordance with the FCA’s Remuneration Code, which is the responsibility of the Board. The aim of the remuneration policy and governance framework is to establish, implement and maintain remuneration policies, procedures, governance and practices that:

– are in line with the business strategy, and the sustained, long-term performance of the Firm;

– neither encourage, nor reward risk taking outside the Board’s appetite; and

– promote sound and effective risk management.

5.2 Link between Pay and Performance

Remuneration at CAML is comprised of fixed pay and variable, performance-related pay.

Fixed pay refers to the employee’s base salary. This forms the core element of pay and reflects the individual’s role and position within the Firm.

Variable, performance related pay refers to discretionary bonus payments. The Firm considers both individual and firm level performance as factors to determine bonus payments.

CAML has identified approximately 35 staff who have a material impact on the risk profile of the Firm; for the financial year to 31 March 2023, the total remuneration for these staff was circa £3.6m.